Insurance plans often have percentages to calculate in order to determine what the individual owes and what the insurance company will pay.

First, a person usually has to meet a deductible. A deductible is amount of money a person has to pay for their expenses all on their own before the insurance company starts helping out. There are sometimes items that insurance companies will pay for a person without that person reaching their deductible, though (like a regular checkup to a primary care physician).

After a person’s medical expenses have passed the deductible, the insurance company starts paying some of the costs. Coinsurance is the percent of costs that you have to pay after the deductible. The insurance company pays the rest.

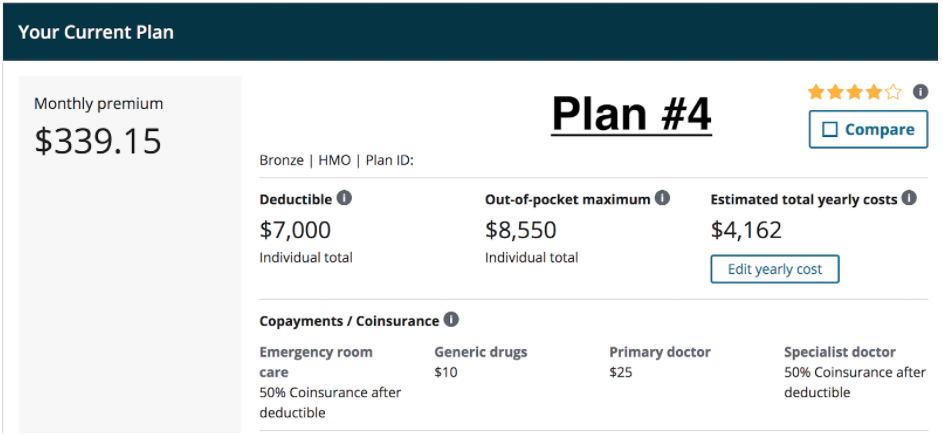

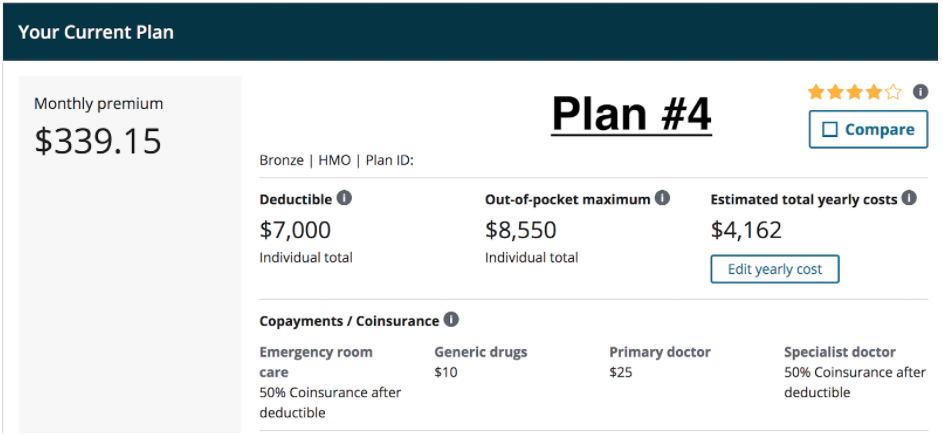

Below is an insurance plan offered to an individual in 2019:

This individual gets to see their primary care doctor for $25 and get prescribed generic drugs for $10.

The insurance company pays the rest of the bill.

For other healthcare, though, they have to pay the entire bill themselves until they reach their deductible of $7,000.

After they pay the deductible, they pay 50% of both emergency room costs and costs for visiting a specialist.

Once they have paid $8,550 out of their own pocket, the insurance company pays the rest.

They have to pay $339.15 a month for the plan.

1.

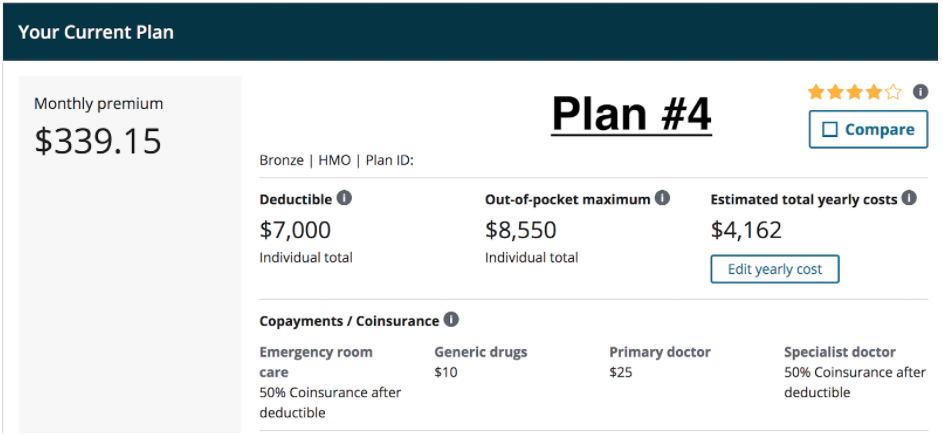

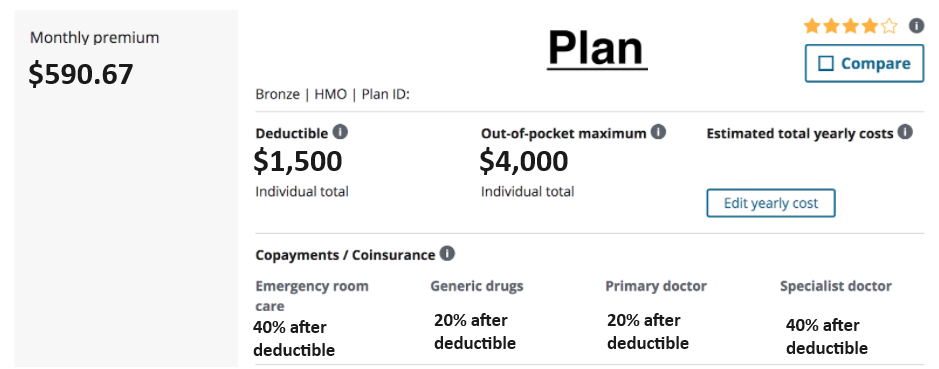

A person has the following health insurance plan:

The person has the following healthcare expenses for a year:

A primary doctor’s visit that cost $500 on January 5th.

Prescription drugs that cost $100 on January 5th.

A visit to a specialist on February 1st that cost $2,000

Prescription drugs that cost $100 on February 5th.

A trip to the emergency room that cost $4,000 on March 8th

If there are no other healthcare expenses, what does the individual have to pay this year for healthcare costs?

The person has to pay all healthcare expenses until they have met the deductible.

They have to pay the full $500 on January 5th as they haven’t met the $3,000 deductible.

The $100 prescription drugs + $500 doctor visit still doesn’t meet the deductible.

By the time the specialist bill is incurred, the deductible has not been reached. If we add another $2,000, the deductible still has not been reached. $2,600 in healthcare costs have been paid by the individual.

The prescription drugs on February 5th put the total cost at $2,700

The emergency room cost puts them over their deductible. $3,000 - $2,700 = $300 of the $4,000 emergency room needs to go toward the deductible. The remaining $4,000 - $300 = $3,700 of the emergency room visit is partially paid by the insurance company and partially paid by the plan holder. The coinsurance is 30% after the deductible. This person owes an additional \(\$3,700 \cdot 0.30 = \$1,110\) for the emergency room.

Their total healthcare costs are the $3,000 deductible + $1,110 for their coinsurance portion of the emergency room, which is $4,110. If we add the cost of their $449.72 monthly premium, their total healthcare cost and health insurance cost for the year is \(\$4,110 + 12 \cdot \$449.72 = \$9,506.64\)

2.

Say the individual above had one additional visit to the

specialist. The specialist performed an expensive procedure that cost

$20,000. What are their total healthcare costs for the year, including

the premium?

Before part 2, the individual had $4,110 in healthcare expenses. They have passed the deductible. The individual is responsible for 30% of the cost of the specialist after the deductible. Their share is \(0.30 \cdot \$20,000 = \$6,000\). Their total healthcare expenses are \(\$4,110 + \$6,000 = \$10,110\), but their out-of-pocket maximum is $7,500. That means They do not have to pay all of the $6,000 from their coinsurance. Once a person reaches their out-of-pocket maximum, the health insurance company pays everything else. This person has to pay $7,500 in healthcare expenses and the premium for the year.

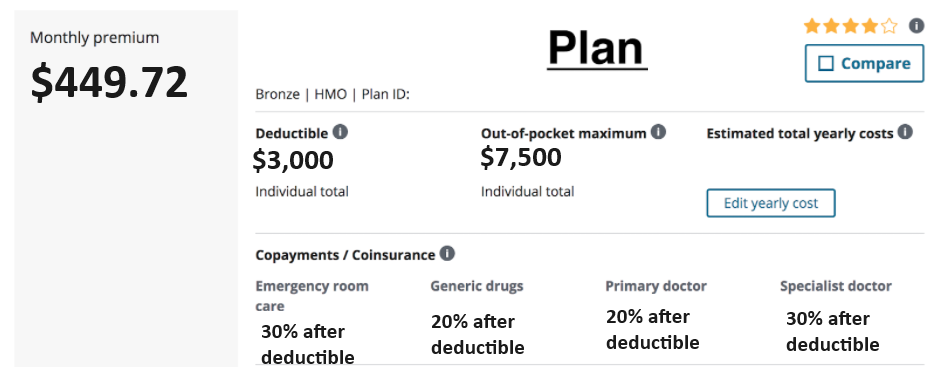

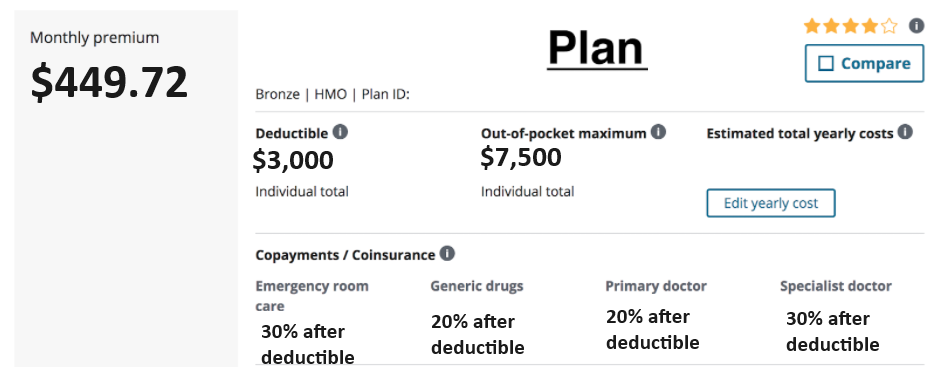

1. A person has the following health insurance plan:

A primary doctor’s visit that cost $500 on June 20th.

A visit to a specialist on August 16th that cost $1,500

A visit to the emergency room on December 4th that cost $1,000

If there are no other healthcare expenses, what does the individual have to pay this year for health insurance and healthcare costs?

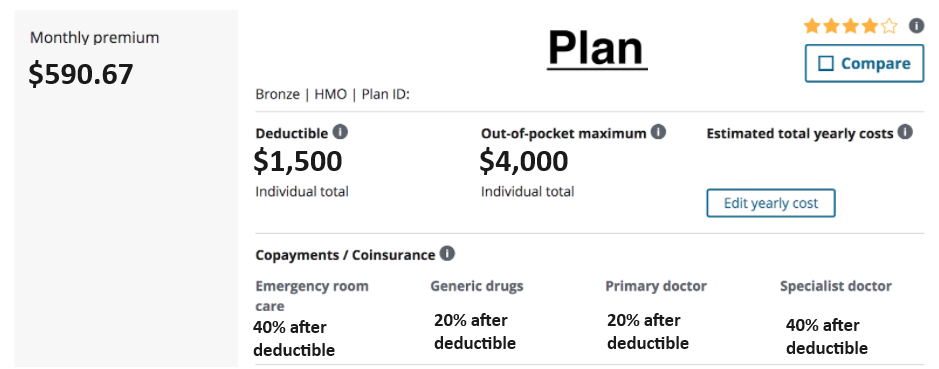

2. A person has the following health insurance plan:

A primary doctor’s visit that cost $500 on March 1st.

A visit to a specialist on March 5th that cost $2,500

A surgery by a specialist that cost $15,000 on April 9th

Prescription drugs that cost $100 on April 9th

Prescription drugs that cost $100 on May 9th

A visit to their primary doctor on May 16th that cost $500

If there are no other healthcare expenses, what does the individual have to pay this year for health insurance and healthcare costs?

1. Compare the two plans above. Which plan would be best for a 21 year old individual with no previous health problems and who typically visits their primary doctor once a year? Why?

2. Compare the two plans above. Which plan would be best for a 57 year old individual who expects to have an expensive surgery in the coming year, who needs several prescription drugs, who has had a history of emergency care, and who visits their primary care doctor at least twice a year? Why?